A psychology measure gives investors important tools to understand human investment related behaviors for better financial decision making and planning.

The crucial key to investing success actually is something investors never expected. It is not a breakthrough stock picking formula or other hot investing tips. Rather, research shows that it is investor psychology playing an important role for achieving long-term investment objectives.

Why are psychology measures important to investors?

The crucial key to investing success actually is something investors never expected. It is not a breakthrough stock picking formula or other hot investing tips. Rather, research shows that it is investor psychology playing an important role for achieving long-term investment objectives.

Why are psychology measures important to investors?

- help select and decide your investment plan with best fit risk tolerance level correctly measured

- help understand human capital value and life cycle income needs are important factors for making investment decisions

- help evaluate investments and advisors to find the right match to your personality type

- help overcome human emotional weakness to stay the course for reaching goals

|

4T-10C Risk Measurement System (4T10C) includes TEN investor behavioral assessment questions which examine FOUR types of investors' personality to come up a simple 10-points scoring system. Investment portfolio with its matching risk level can then be designed and tracked accordingly.

4T10C scoring is very simple: each "YES" answer to any of the following ten "C" questions under four "T" behavioral categories adds one point (0.5 point is acceptable if the answer is not sure). Higher total point indicates that the investor being measured has higher risk tolerance. Portfolio risk tolerance can then be proposed based on the investor's 4T10C score: 0-2 is "conservative"; 3-4 is "moderate conservative"; 5-6 is "moderate"; 7-8 is "moderate aggressive"; and 9-10 is "aggressive". Time - When do you need money? (Principle: Time and diversification will help reduce risks) (1) Commitment - Do you commit to invest for long-term? (2) Comfort - Do you have current income so not to worry investment loss? (3) Continue - Do you stay the course for continuous improvement? Type - What is your personality type? (Principle: Emotion control capability has big impact on investor success) (4) Confidence - Do you make firm decision when selecting investments? (5) Courage - Do you buy more when market price drops? (6) Conquer - Do you prefer higher returns along with higher volatility? Tolerance - Can you take risk? (Principle: Knowledge and understanding determine risk tolerance) (7) Concentration - Do you prefer to invest most of your money in only one asset class (such as stocks, bonds, real estates; gold; annuity; or CDs)? (8) Competency - Do you understand your investments? Timing - Do you fear about crisis? (Principle: Crisis means risk; but it can also present new investment opportunities) (9) Calm - Do you believe any crisis caused by sudden economic or political events is always temporary? (10) Creative - Do you like to listen to and try new investment ideas? A systematic investing process incorporating 4T10C risk measurement can be found here. |

|

Myers-Briggs Type Indicator (MBTI) is a personality test which groups people into one of 16 personality profiles. Many real world examples show that investing success depends on investors' personality types, often matter far more than the nuts and bolts of their portfolios.

By applying MBTI test, a four-letter personality score can be used to capture an investor's preferences in the following areas:

One way to categorize investors' personality types can be described as four P's: Protectors, Planners, Pleasers, and Players. Protectors (MBTI Types: ESTJ, ESFJ, ISTJ, and ISFJ) - These people are, by nature, very conservative. These investors are difficult to be convinced even to take advantage of minimal-risk investments. This personality type can have a lot of trouble with market and their own portfolio volatility. Prepare for the unexpected by having a full emergency fund, which should cover at least six months of net income. Planners (MBTI Types: ENTJ, ENTP, INTJ, and INTP) - These types will be more into longer-term investing since they are better able to take risk with contingency plans. These investors are competent and view themselves smarter than other people. One weakness of "Planner" is they sometimes miss opportunities because they are so confident in what they have believed in and thus become less open-minded. Pleasers (MBTI Types: ENFJ, ENFP, INFJ, and INFP) - These investors take money personally, often as an extension of themselves. They try to please themselves or please others, e.g., overspending. A Pleaser is more about the emotional, "relational" needs of themselves and others. They can be subject to financial abuse at the hands of individuals who may take advantage of the Pleasers' desire to put others' needs above their own. Players (MBTI Types: ESTP, ESFP, ISTP, and ISFP) - Players love having the freedom to merely react to the moment. They are characterized by a tendency to be compulsive, and are unlikely to think long-term. Players are often the ones taking the highest financial risk. These types are going to be overly impulsive and optimistic about risks, poor about planning. One good free source of taking the MBTI test can be found here. |

|

Gamma measures the additional expected retirement income achieved by an individual investor from making more intelligent financial planning decisions. This is a step beyond the familiar concept of Alpha and Beta, where Beta measures exposure to systematic risk (and the associated expected return), while Alpha measures the excess (or negative) returns created beyond those simply due to market beta exposure.

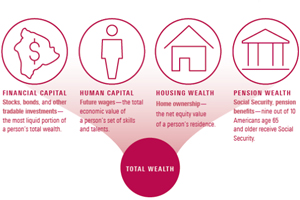

Note that Gamma is similar to alpha in that it measures a form of excess return and value brought to investors. The difference, however, is that Gamma is a result of financial planning decisions by considering the role of lifetime human capital, rather than merely investment decisions. In calculating Gamma, five important financial-planning decisions and techniques are considered: a total wealth framework to determine the optimal asset allocation, a dynamic withdrawal strategy, the incorporation of guaranteed income products, tax-efficient allocation decisions, and a portfolio optimization that includes liabilities. In a world where the value of financial advisors is so difficult to measure, Gamma offers a new measure to justify the fee that an advisor charges for financial planning and portfolio management. For example, with a 1.5% of Gamma, the advisor charging 1% annual fee creates a net positive effect on generating retirement income, in addition to managing retirement assets and providing ongoing financial planning advice. Gamma's focus is on income, the main source of risk in the model is the uncertainty of income. The finding has important implications for financial planning, particularly with respect to the kind of information that advisors collect from their clients using questionnaires. Specifically, while most financial planning questionnaires are designed to elicit information about an investor's investment horizon and risk tolerance, Gamma's research inspires incorporation of this aspect of investor income preferences into financial planning practices. In summary, the concept of Gamma not only provides some quantification as to the value of financial advice, it also points the way to a more comprehensive view of what it means for financial advisors to know their clients. A comprehensive Gamma presentation can be found here. |

Other Notable Measures for Investor Psychology Evaluation

Various investor questionnaires have been widely adopted by many financial institutions and planners. There are other popular investor behavior profiling systems that could also be indispensable tools for investor's in-depth research process. Understanding investor psychology can greatly influence investors' long-term financial plan, as well as the decisions of selecting their investment asset allocations and advisors. Other significant resources for investor psychology evaluation include

Various investor questionnaires have been widely adopted by many financial institutions and planners. There are other popular investor behavior profiling systems that could also be indispensable tools for investor's in-depth research process. Understanding investor psychology can greatly influence investors' long-term financial plan, as well as the decisions of selecting their investment asset allocations and advisors. Other significant resources for investor psychology evaluation include

- Investor Risk Tolerance Questionnaires are simple sheets including investor behavior related questions provided to investors to answer. Most financial advisors and planners use these questionnaires as an effective tool to determine the risk level of investors' asset allocation. Two good examples are: Investor Profile Questionnaire and Identifying Your Investor Profile.

- Discovering Why Smart Investors Make Foolish Mistakes drives investor behavior research and case studies to understand investor psychology. Investors are humans, sometimes a costly mistake is easily caused by our emotions because there is always something they do not know. The 365 Principles of Investing is a summary of investor behavioral study collected and written by Dr. Charlie Q. Yang from his research on market and investor behaviors. Each of them serves as a reminder for us to avoid making the same mistake again.

- Financial Planning Lifestyle Workbooks are a set of investor questionnaires designed for financial planners developed by MoneyGuidePro. These tools can be useful for investors to work towards a meaningful financial plan based on personal incomes (e.g. social security, pension), all types of assets, insurance and liabilities, insurance and estate needs, and budget.