One very serious problem in financial industry today is lacking a set of scientifically sound and easy to understand measuring standards for investors to uncover many flawed investment strategies sold to them. Informed investors must learn how to measure the added value, if any, of their investment advisory in order to prevent losses due to wrong claims and unjustified fees.

Welcome to InvestmentStandards.com, an online source of important ratios for measuring investments. It is sponsored by the Institute for Systematic Investment Research (ISIR). It is dedicated to advance the research in investment measurement standards. Our goal is to equip investors with knowledge and simple tools for effectively evaluating the quality of investments and their advisors.

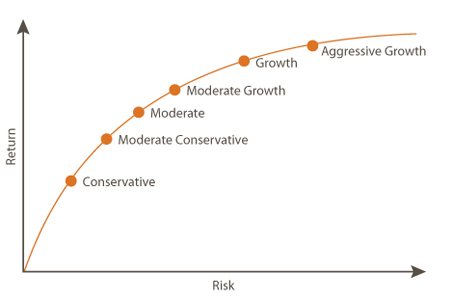

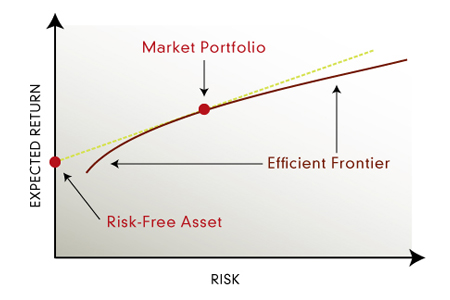

At present, many investors are still facing inconsistent and misleading information presented by financial firms and their advisors. For example, the two charts shown below are a portfolio benchmark line (left) and the efficient frontier line (right). Investors are not informed that an actively managed portfolio can possibly out-perform the benchmark line (left). It must not be confused with the efficient frontier (right) which should not be used as an actual benchmark line for portfolio evaluation.

Welcome to InvestmentStandards.com, an online source of important ratios for measuring investments. It is sponsored by the Institute for Systematic Investment Research (ISIR). It is dedicated to advance the research in investment measurement standards. Our goal is to equip investors with knowledge and simple tools for effectively evaluating the quality of investments and their advisors.

At present, many investors are still facing inconsistent and misleading information presented by financial firms and their advisors. For example, the two charts shown below are a portfolio benchmark line (left) and the efficient frontier line (right). Investors are not informed that an actively managed portfolio can possibly out-perform the benchmark line (left). It must not be confused with the efficient frontier (right) which should not be used as an actual benchmark line for portfolio evaluation.

Remarks: Some advisors with inferior performance misled investors by saying that their advised portfolio should always under-perform the efficient frontier performance as predicted by the modern portfolio theory (MPT). Actually, even these two lines look alike, they are plotted with two sets of different data. The portfolio benchmark line (left) is the performance achievable with passive allocations of indexes, while the efficient frontier line (right) is a theoretical maximum achievable performance line under a set of overly simplified assumptions.

By accessing one of sections below, investors can learn most important traditional and newly-developed performance ratios and measures for stocks, portfolios, benchmarks, and investor behaviors.

Remarks: With the Global Investment Performance Standards (GIPS) from the CFA Institute being adopted in financial industry, we are sharing our mission to give investors the transparency they need to compare and evaluate investment managers. However, it must be noted that the GIPS Standards are designed with financial institutions in mind, not for much less sophisticated consumers. Our efforts here are to develop a set of understandable and consumer desired investment performance standards. The ultimate goal is to empower investors who can be vulnerable to any unethical and profit-driven financial industry behaviors.